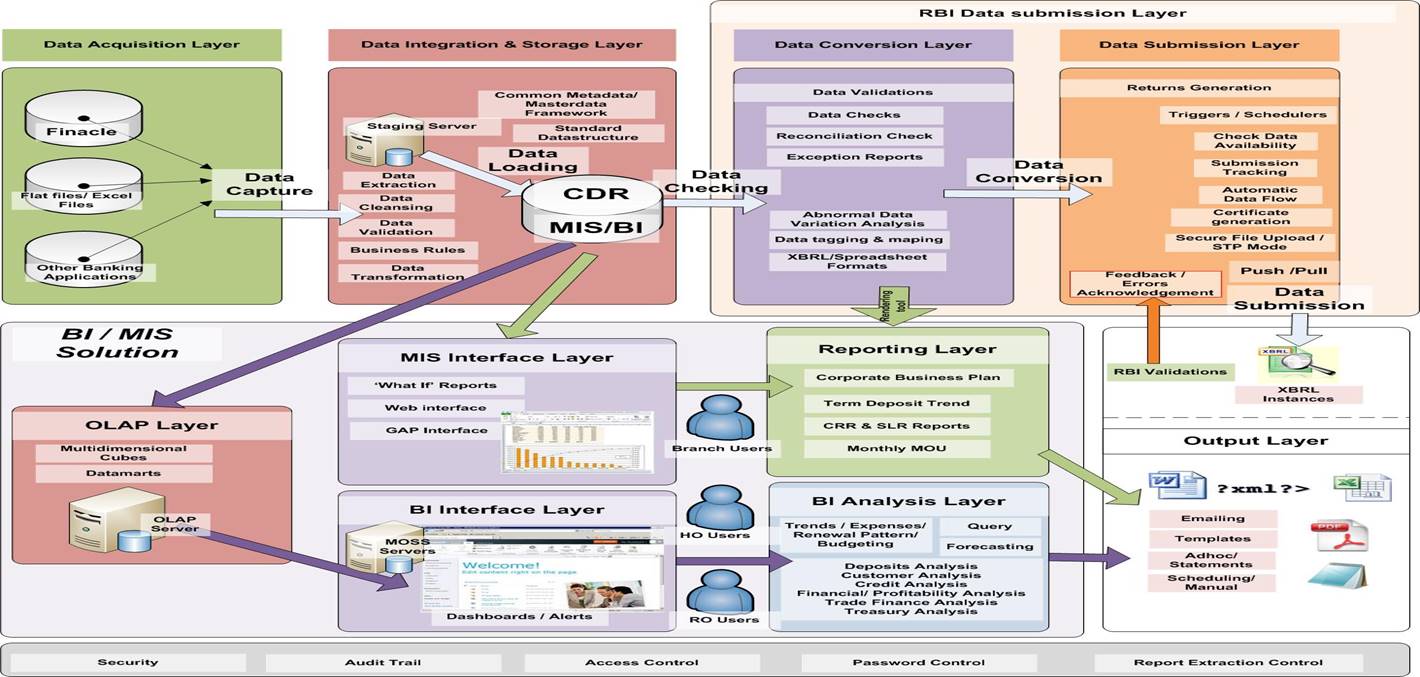

BankSys is a robust, data warehouse-based Management Information System (MIS) purpose-built for banks to centralize and transform operational data into actionable insights. It seamlessly consolidates data from Core Banking, Mobile Banking, Internet Banking, and other disparate systems, providing a unified, up-to-date, and holistic view of all banking activities.

By offering a single source of truth for both financial and non-financial information, BankSys eliminates data silos and enables informed, real-time, and strategic decision-making across all levels of the enterprise.

Integrated Capabilities:

Enterprise Data Warehousing

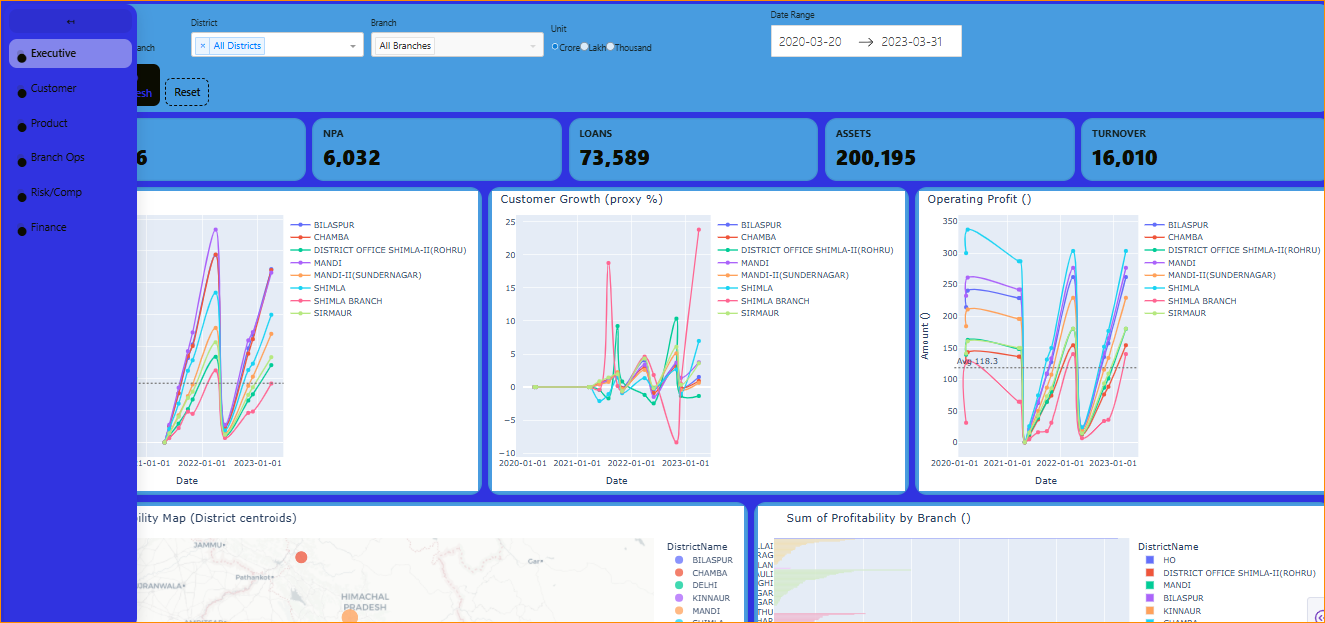

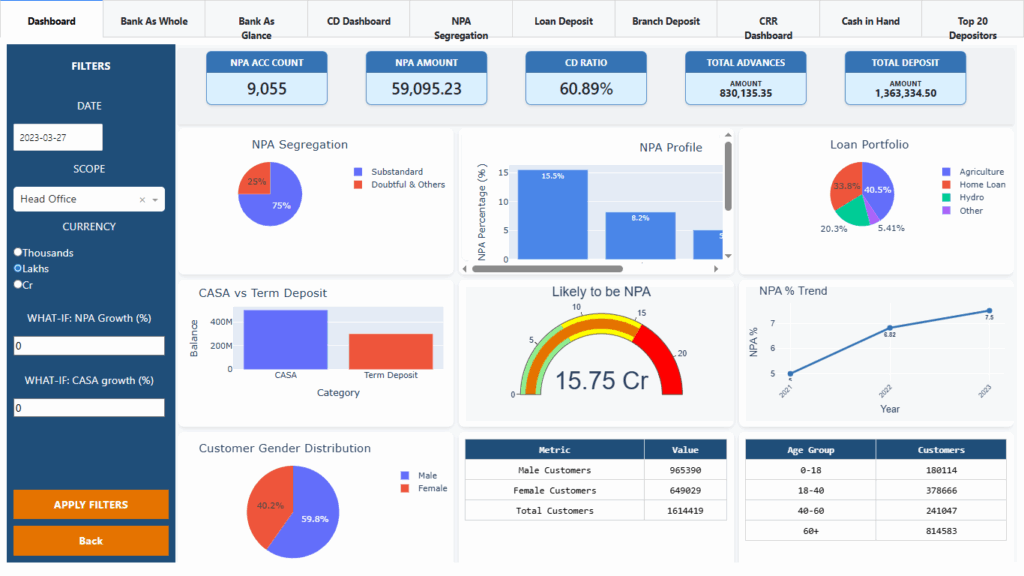

Real-Time Dashboards

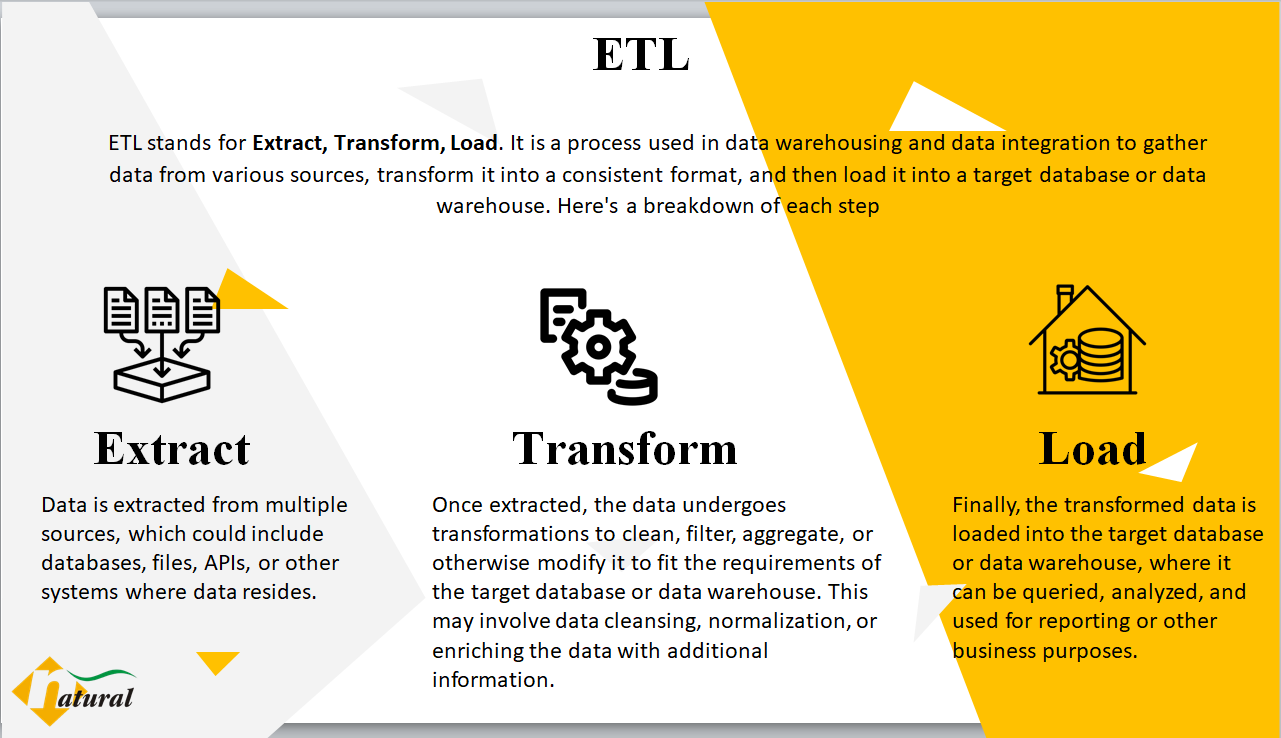

Automated ETL (Extract, Transform, Load) Workflows

Regulatory and Internal Reporting

BankSys empowers banks to achieve greater transparency, agility, and data-driven performance in today’s competitive financial landscape.

Proven Track Record

BankSys is trusted by leading financial institutions, including national and rural banks, for robust MIS, analytics, and regulatory compliance.