Our Clients – Partners in Rural Progress

Himachal Pradesh State Cooperative Bank (HPSCB)Empowering Rural Banking Across Himachal Pradesh

The Himachal Pradesh State Cooperative Bank (HPSCB) stands as a pillar of financial empowerment in the region — driving inclusive growth through cooperative banking. With a strong rural footprint and a vision for digital transformation, HPSCB connects communities with secure, reliable, and modern banking services.

What Makes HPSCB a Leader in Cooperative Banking?

Statewide Reach — A robust network of branches across urban and rural Himachal, serving thousands of individuals and cooperative societies.

Rural Upliftment — Focused on farmers, self-help groups, and small businesses — supporting local economies at the grassroots level.

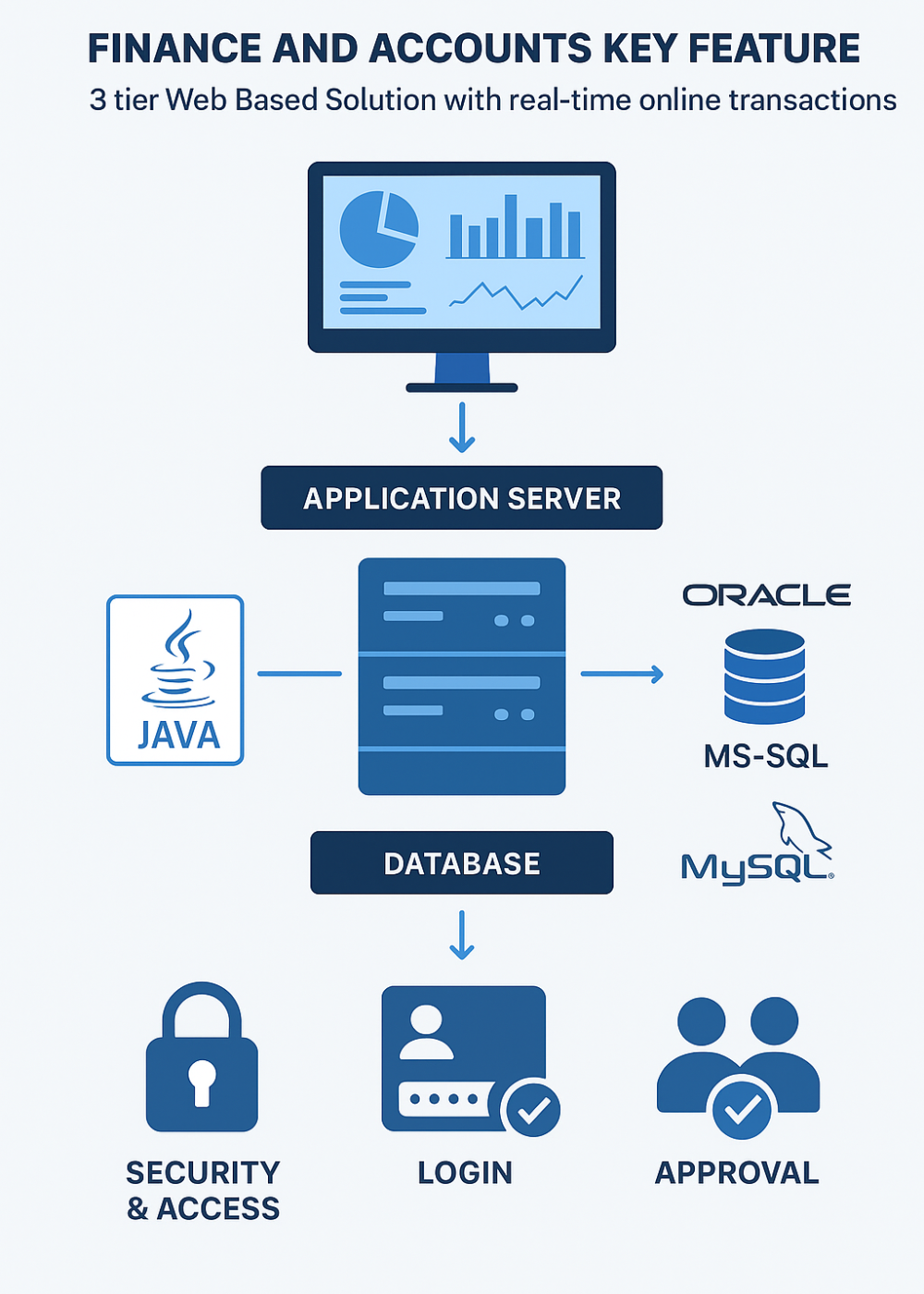

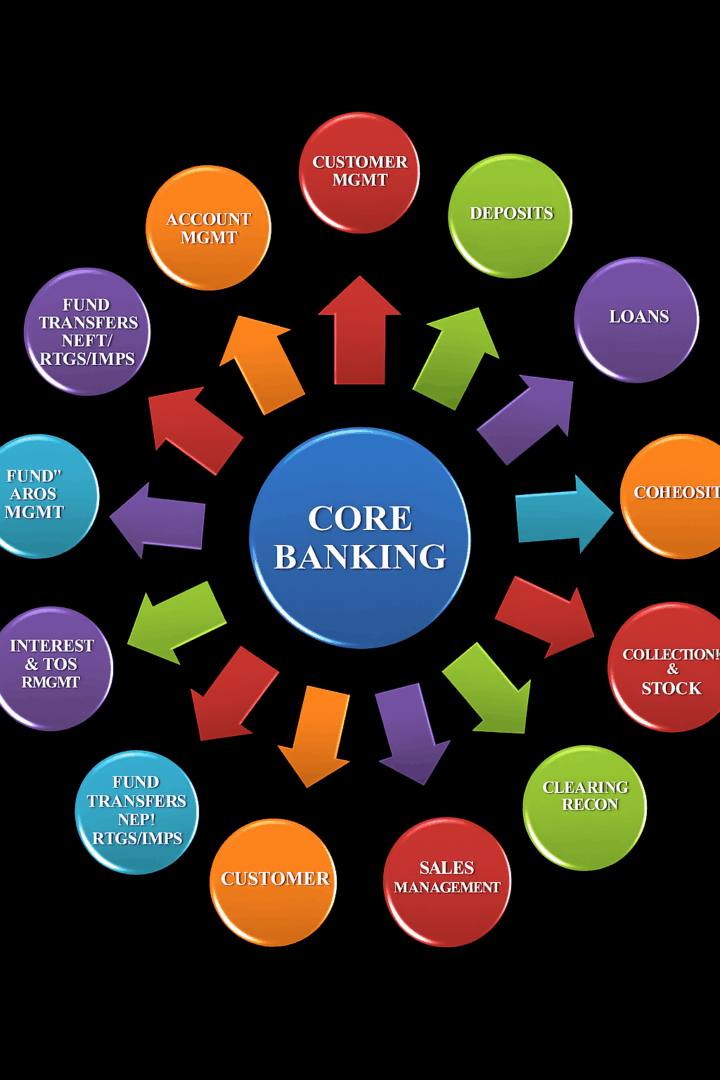

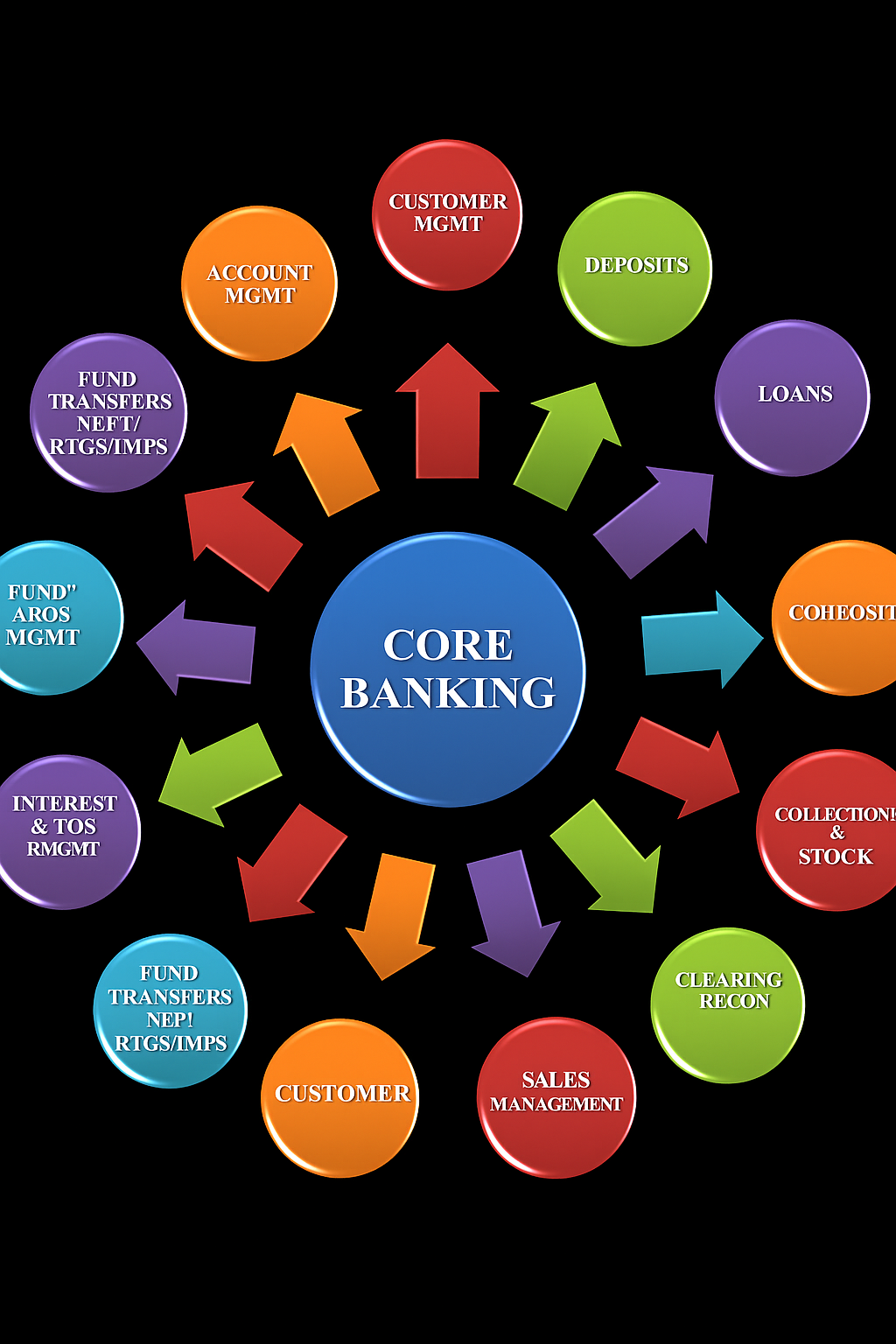

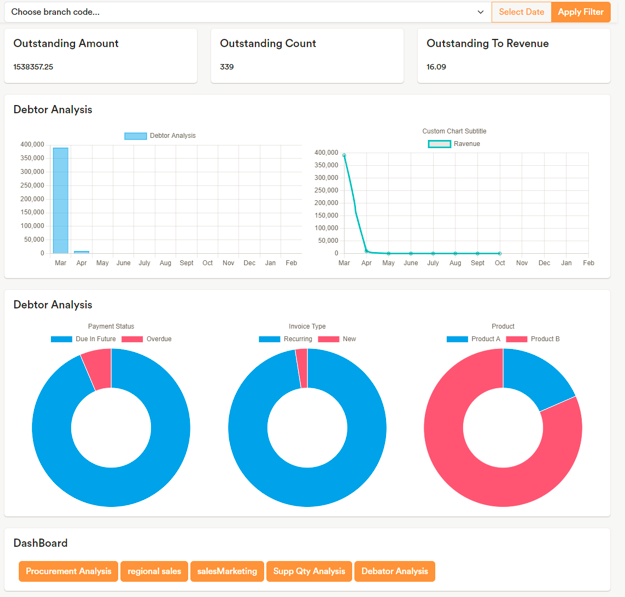

Digital Transformation — Adopting modern Core Banking Systems, digital banking channels, and secure infrastructure.

Financial Inclusion — Committed to bringing unbanked populations into the formal financial system.

Trusted Legacy — Decades of service backed by transparency, integrity, and cooperative values.

Parwanoo Urban Cooperative Bank (PUCB)

Empowering Banking with Modern Core Banking System

Parwanoo Urban Cooperative Bank (PUCB) has successfully adopted a modern Core Banking System (CBS) to enhance its operations and deliver efficient, secure, and digital banking services to its customers.

With the implementation of this CBS, PUCB can now manage accounts, loans, deposits, and transactions seamlessly, offering customers real-time services and a smooth banking experience. This upgrade has strengthened the bank’s ability to serve its urban and semi-urban community more effectively.

Key Benefits of the CBS for PUCB:

Faster Transactions – Real-time processing of deposits, withdrawals, and fund transfers.

Secure Banking – Enhanced data security and fraud prevention measures.

Digital Access – Customers can access accounts and services anytime through digital channels.

Operational Efficiency – Automated workflows reduce manual work and improve accuracy.

Customer Satisfaction – Better service delivery and transparent banking operations.

This step marks a significant milestone for PUCB in modernizing its banking operations, making services more accessible, efficient, and reliable for all customers. The adoption of a CBS reflects PUCB’s commitment to progressive, technology-driven cooperative banking in Himachal Pradesh.

Chamba Urban Cooperative Bank (CUCB)

Modern Core Banking for Efficient and Digital Banking

Chamba Urban Cooperative Bank (CUCB) has successfully implemented a Core Banking System (CBS) to enhance its banking operations and provide fast, secure, and digital services to its customers.

With this system in place, CUCB can efficiently manage accounts, loans, deposits, and transactions, delivering real-time and convenient banking experiences. The upgrade strengthens the bank’s ability to serve its urban and semi-urban communities effectively.

Key Benefits of the CBS for CUCB:

Faster Transactions – Real-time processing for deposits, withdrawals, and fund transfers.

Secure Banking – Improved data security and protection against fraud.

Digital Access – Easy access to accounts and services through digital channels.

Operational Efficiency – Automated processes reduce manual errors and save time.

Customer Satisfaction – Transparent operations and improved service quality.

The implementation of a CBS marks an important step in modernizing CUCB’s banking services, reflecting

Mandi Urban Cooperative Bank (MUCB)

Empowering Banking with Modern Core Banking System

Mandi Urban Cooperative Bank (MUCB) has successfully adopted a Core Banking System (CBS) to strengthen its operations and deliver efficient, secure, and digital banking services to its customers.

With the CBS in place, MUCB can now manage accounts, loans, deposits, and transactions seamlessly, providing real-time and convenient banking experiences. This upgrade enables the bank to serve its urban and semi-urban communities more effectively and efficiently.

Key Benefits of the CBS for MUCB:

Faster Transactions – Real-time processing for deposits, withdrawals, and fund transfers.

Secure Banking – Enhanced data security and protection against fraud.

Digital Access – Easy access to accounts and banking services through digital channels.

Operational Efficiency – Automated workflows reduce manual errors and save time.

Customer Satisfaction – Improved service delivery, transparency, and reliability.

The implementation of the CBS represents a significant step forward for MUCB in modernizing its banking operations, ensuring a technology-driven, customer-friendly, and inclusive banking experience across Himachal Pradesh.