GST Outstanding: Monitor pending GST liabilities and dues for timely compliance.

GST Output: Track total GST collected on sales and outward supplies.

GST Input: View GST paid on purchases to manage input credit efficiently.

Payment Made: Review all payments processed against various expenses or liabilities.

Claim Outstanding Balance: Identify and reconcile pending claims across departments.

TDS Outstanding Balance: Check deducted but unpaid TDS amounts to ensure timely remittance.

Salary Outstanding Balance: Track unpaid or pending salary obligations.

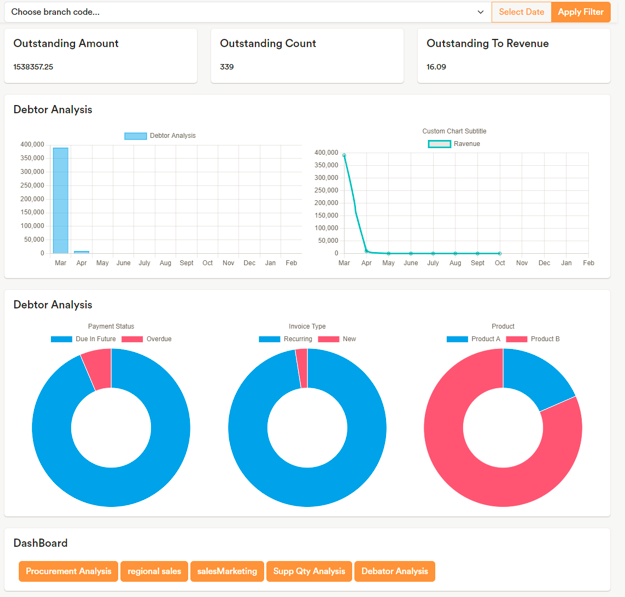

Accounts Receivable Outstanding: Monitor pending customer payments to improve cash flow.

Accounts Payable Outstanding: Manage dues owed to vendors for better financial planning.

Staff Outstanding Balance (Imprest): Keep track of advances given to staff and pending settlements.

MSME Outstanding Balance: Monitor payments due to MSME vendors to comply with statutory timelines.

MSME Overdue Balance: Highlight overdue MSME payments to avoid penalties.

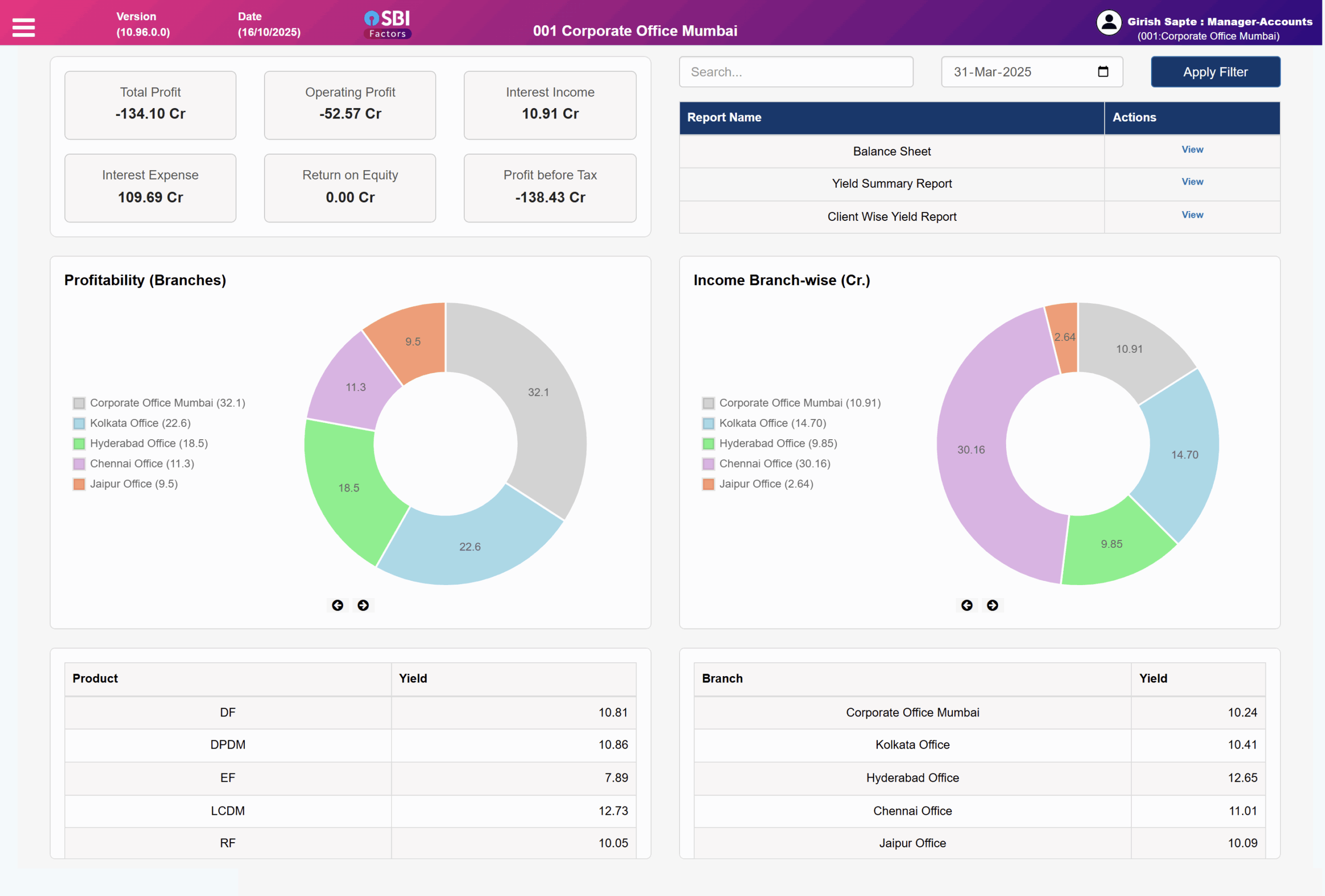

Total Profit: View overall profitability across the organization.

Operating Profit: Analyze profit generated from core operational activities.

Interest Income: Track revenue earned through interest on deposits or investments.

Interest Expense: Record and monitor interest paid on borrowings and loans.

Return on Equity: Evaluate business performance through equity-based profitability.

Profit Before Tax: Review financial performance before taxation impact.

Balance Sheet: Get a real-time snapshot of assets, liabilities, and equity.

Trial Balance: Verify accounting accuracy through consolidated debit-credit summary.

Day Book Reports: View day-to-day financial transactions across all vouchers.

Account Head Ledger: Access detailed ledgers for each account head for audit and analysis